Disclosure based on TCFD recommendations

The Ai Holdings Group regards addressing environmental issues as an essential issue for achieving a sustainable society, and the entire Group is committed to reducing the environmental impact of its business activities by developing ISO-compliant products, providing environmentally friendly products, reducing waste, and conserving resources and energy. In particular, with regard to climate change issues, we have expressed support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) in May 2022. We will actively promote climate change initiatives and disclose our governance, strategy, risk management, indicators and targets related to climate change in accordance with the recommendations.

1.Governance

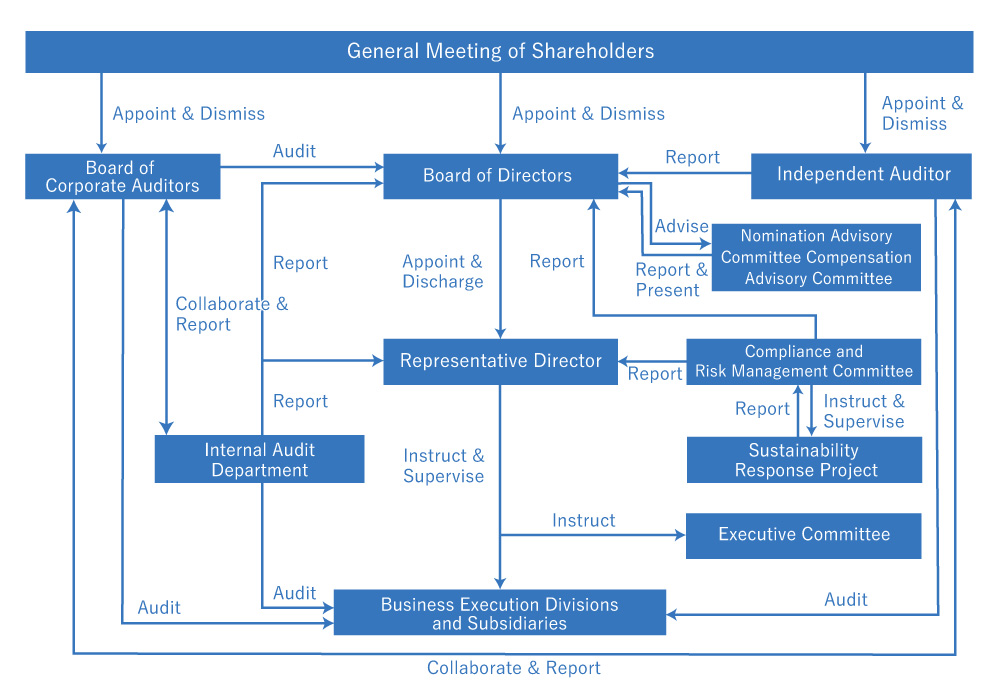

◆Supervisory structure of the Board of Directors

Our Board of Directors recognizes that addressing climate change is one of the most important management issues and supervises it not only from the perspective of risk management but also from the perspective of business creation. Specifically, our Board of Directors supervises and instructs each division and subsidiary by managing business strategies, as well as various measures and business targets, in light of addressing climate change, from the perspectives of both risk management and business creation. In addition, we established a system for our Board of Directors to receive reports from the Compliance and Risk Management Committee on the status of the Group’s sustainability initiatives, including climate change initiatives, as necessary.

◆Role of Management Team

With a view to strengthening our sustainability initiatives, including climate change response, we established the Sustainability Response Project as a subordinate body of the Compliance and Risk Management Committee. Under the direction and supervision of the Compliance and Risk Management Committee, the Sustainability Response Project supervises and shares information as appropriate on climate change response efforts in each division and subsidiary. Through the Compliance and Risk Management Committee, the Representative Director supervises the Group’s efforts to deal with climate change and, as necessary, instructs the business execution divisions and subsidiaries on countermeasures and other matters.

(Governance Structure Chart)

2.Strategy

We evaluated the risks and opportunities that climate change poses to our business strategy based on two scenarios, the 2 °C scenario and the 4 °C scenario, and discussed measures to respond to these scenarios. The assumptions used in the scenario analysis were as follows.

This year, the analysis focused on two companies, Ai Holdings Corporation and Dodwell B.M.S. Ltd. The year 2030 was selected as the time horizon for analysis, and the IEA’s SDS scenario (Sustainable Development Scenario) and the IPCC’s RCP 2.6, etc. were used for the 2 °C scenario, and the STEP scenario (Stated Policies Scenario) and the IPCC’s RCP 8.5, etc. were used for the 4 °C scenario.

Assumptions for scenario analysis

| Assumptions | Scope |

|---|---|

| Scope of companies | Ai Holdings Corporation, Dodwell B.M.S. Ltd. |

| Analysis timeline | 2030 |

| Selected Scenarios | [2 °C] IEA SDS scenario, IPCC RCP2.6 scenario [4 °C] IEA STEP scenario, IPCC RCP8.5 scenario |

IEA (International Energy Agency)

IPCC (Intergovernmental Panel on Climate Change)

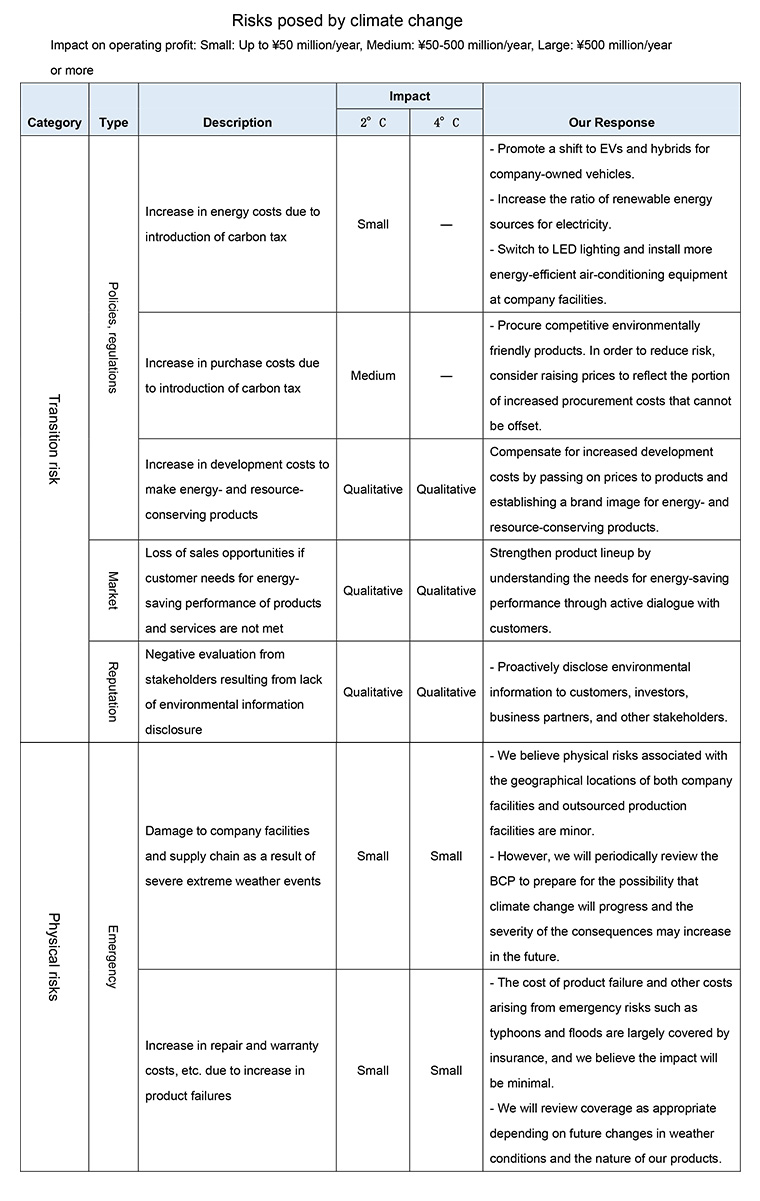

①Climate Change Risks

In the 2 ℃ scenario, we expect costs to rise with the introduction of a carbon tax and an increase in the number of environmentally friendly products. In response, we will strive to reduce our impact by actively working to use renewable energy and conserve energy at our business facilities, procuring competitive environmentally friendly products, and setting appropriate prices.

In the 4 ℃ scenario, although we believe that the physical risk at our main facilities is currently low, we will continue to regularly inspect our business continuity plan (BCP) and review our insurance coverage for typhoons, floods, and other disasters to ensure that the impact of even more severe extreme weather events will be minimal.

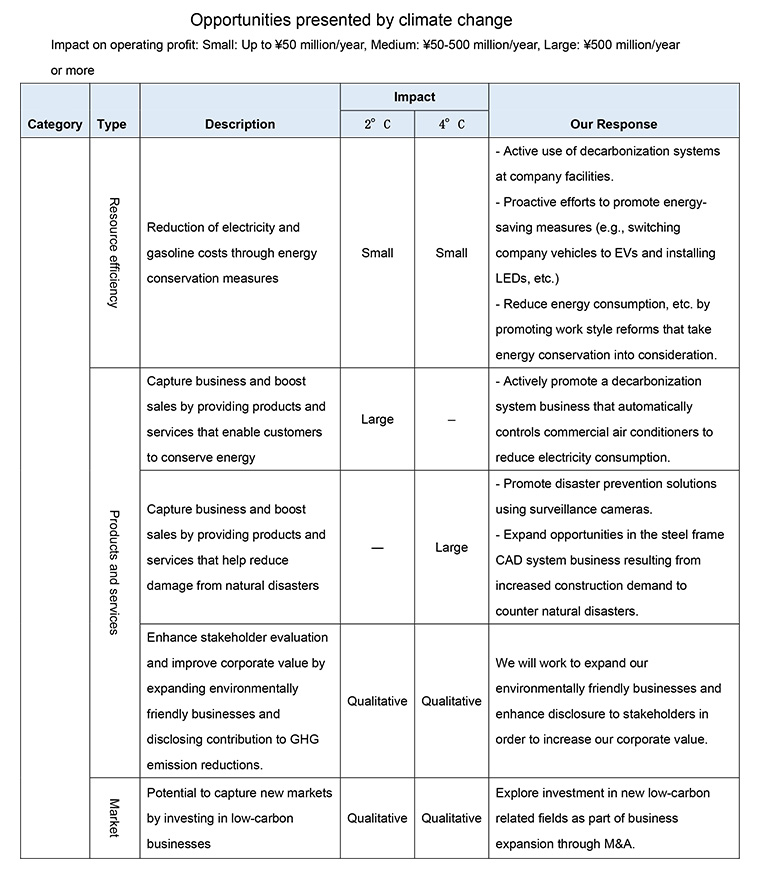

②Climate Change Opportunities

Under the 2 ℃ scenario, we can assume that customers will become even more energy-conscious. To address this, we will proactively provide solutions to help customers conserve energy and resources by focusing more on expanding sales of energy-saving products, such as decarbonization systems that automatically control commercial air conditioners to reduce electricity use, which will lead to business opportunities for our company. In addition, we will explore opportunities to expand our business into new low-carbon related fields through M&A.

Under the 4 °C scenario, we are concerned that there will be more natural disasters compared to today. In response, we will help reduce the damage caused by such natural disasters by providing disaster prevention solutions using surveillance cameras and steel frame CAD systems to meet the increasing construction demand to counter natural disasters.

3.Risk management

Risk management

◆Organizational process for identifying and assessing climate-related risks

The Ai Holdings Group plans to identify and assess climate-related risks in its Sustainability Response Project. Based on a scenario analysis of transition and physical risks related to climate change, we will identify risks and opportunities, and will assess the materiality of these risks in light of their financial impact, while simultaneously examining countermeasures.

◆Organizational process for managing climate-related risks

Material risks, including climate-related risks, identified and assessed as part of the Sustainability Response Project are reported to and shared with the Representative Director and the Board of Directors as necessary through the Compliance and Risk Management Committee, and appropriate countermeasures will be considered. Specifically, among the risks related to climate change, the Board of Directors will deliberate on risks that may have a material impact on the Group’s management as necessary, and will examine ways to prevent risk events from materializing. It will also consider measures to respond to such events if they do materialize through instructions and reports to the business execution divisions and subsidiaries.

◆Integration into overall risk management of the organization

Our company has established the Compliance and Risk Management Committee as a company-wide risk management system, and at the same time, we have established the Risk Management Regulations to manage risks across the organization. Specifically, the Compliance and Risk Management Committee selects and deliberates on material risks that could result in substantial losses within the Group, and reports to the Executive Committee and the Board of Directors to strengthen the overall risk management system and countermeasures. In addition, each division, including Group companies, designates a risk management officer who oversees risk management and reports monthly on the progress of risk management to the Committee. In case of important matters, the officer reports to the Committee as needed. Sustainability risks identified and assessed as part of the Sustainability Response Project, including climate change risks that could materially impact the Group, are also reported to the Representative Director and the Board of Directors by the Compliance and Risk Management Committee as necessary, so that countermeasures can be discussed.

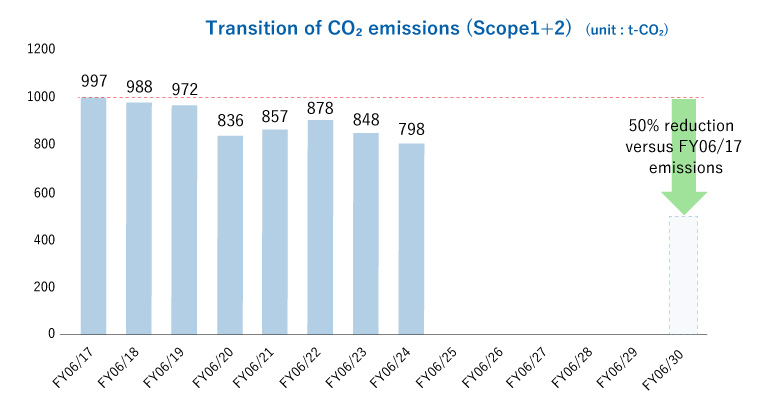

4.Indicators and targets

We use the CO2 emission reduction rate as an indicator for evaluating our climate change initiatives. Our target for FY06/30 is to achieve a 50% reduction in CO2 emissions compared to our FY06/17 emissions.

| unit:t-CO₂ | FY06/17 | FY06/18 | FY06/19 | FY06/20 | FY06/21 | FY06/22 | FY06/23 | FY06/24 |

|---|---|---|---|---|---|---|---|---|

| Scope1 | 723 | 676 | 667 | 631 | 676 | 674 | 681 | 646 |

| Scope2 | 274 | 312 | 305 | 205 | 181 | 204 | 167 | 153 |

| Scope1,2合計 | 997 | 988 | 972 | 836 | 857 | 878 | 848 | 798 |

*Scope1: Direct emissions from use of fuels such as gasoline and diesel.

*Scope2: Indirect emissions from use of purchased electricity.